how to get a payday loan with bad credit?

What is the Difference between a beneficial Co-Signer and you may an effective Co-Borrower?

Consider all of our composing cluster such as your Yoda, having expert loans information you can rely on. MoneyTips demonstrates to you basics only, in place of features otherwise foregone conclusion, to live the best monetary lifetime.

Get the PersonalLoan Possibilities

If you find yourself searching for that loan otherwise a line away from borrowing from the bank, dependent on your debts, you may have to incorporate with someone else. Enter the co-signer or co-debtor.

Whether you’re offered asking you to definitely action on one among them spots, otherwise you’re considering entering one among these opportunities, you will need to understand dangers and you can duties of every one to.

If you query people to be an effective co-signer otherwise a co-debtor? For anyone who is a beneficial co-signer otherwise a great co-debtor? So you can choose which role best suits your situation, we are going to glance at some secret areas of being a beneficial co-signer and you can a good co-borrower.

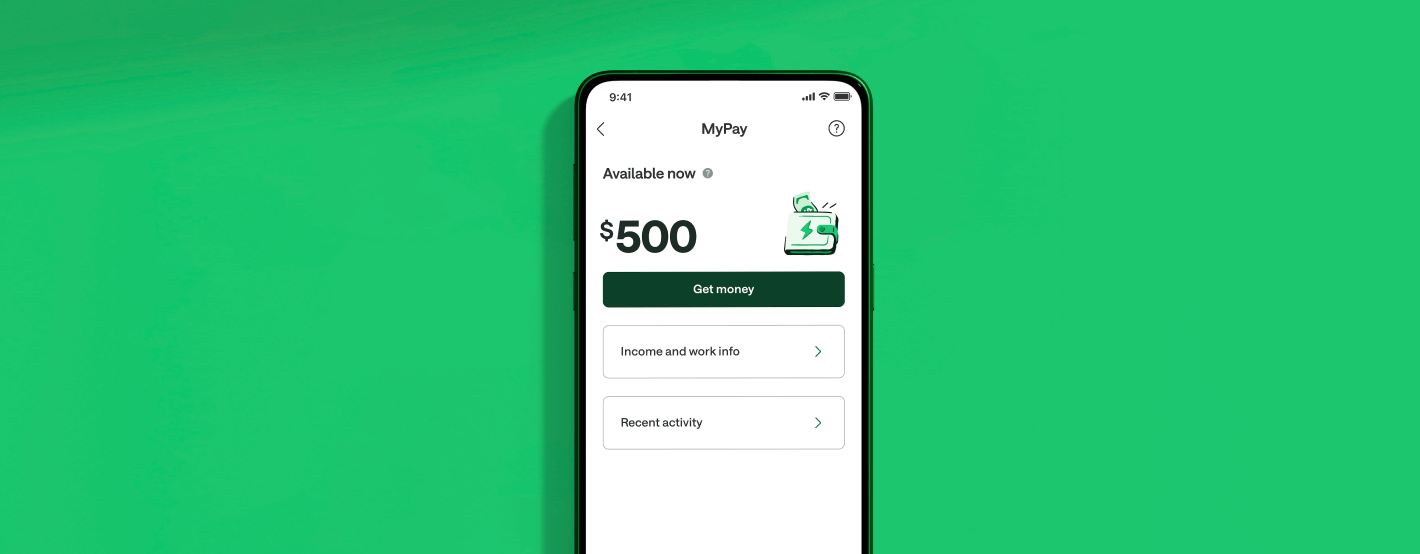

You desire Cash?

Trying to get a personal bank loan has never been convenient. Obtain the cash you prefer having aggressive terms away from Skyrocket Money SM .

What is actually a beneficial Co-Signer?

A great co-signer signs onto a loan (or bank card) to aid an initial borrower meet the requirements otherwise advance terminology. When you’re month-to-month financing otherwise card costs could be the first borrower’s duty, when you are a great co-signer, you are agreeing to make monthly obligations in case the first debtor can’t.

The ideal co-signer have to have a high credit score and you can/or earn more income compared to the number 1 debtor. Lenders review both the number one borrower and co-signer’s credit rating and you can income from inside the application processes. The fresh new co-signer’s more powerful monetary and credit reputation is improve the chances of loan approval towards no. 1 debtor.

Co-signers are nearby the priily representative, a partner otherwise a buddy. Including, when you have a finer credit rating otherwise bad credit but you would like a car loan otherwise an exclusive education loan, you can ask one of the mothers in order to co-sign your loan to acquire recognized.

Advantages of being an effective Co-Signer ??

For as long as an important borrower have and then make its monthly installments, a good co-signer isnt accountable for mortgage repayment, plus it doesn’t apply to its credit scores.

There is the fulfillment from knowing your helped someone close so you can you accomplish a monetary mission by the helping them safer investment.

Downsides to be a beneficial Co-Signer ??

Whether your number 1 debtor non-payments, you must pay-off the mortgage. In case the repayments are late or if you skip costs, the fico scores will be damaged.

It may be more challenging to obtain a loan since the co-finalized personal debt might show up on your credit history, affecting your financial obligation-to-earnings (DTI) proportion.

What is actually a great Co-Borrower?

Good co-debtor, aka a co-candidate, matches pushes to your number 1 borrower to get financing to each other. All of the co-consumers have the effect of repaying the borrowed funds, each features use of new loan’s assets whether it’s a vehicle or money from a consumer loan.

Lenders comment borrowers’ creditworthiness and you can earnings to help you accept the borrowed funds software. He is very likely to agree a high loan amount or most useful financing words, such as for example a reduced interest rate, since there are one or two individuals in the place of that.

If at all possible, need a co-debtor with good credit and you will a stable money once the you’re each other accountable for loan cost. But instead of co-signers, an excellent co-borrower’s income need not be higher than the main borrower’s money.

Co-individuals usually borrow cash to own combined options. Particularly, both you and a buddy may wish to enter into providers together and need a corporate otherwise personal bank loan for your business. For individuals who make an application for the borrowed funds due to the fact co-consumers best Illinois personal loans, your for every you will definitely accessibility the amount of money. And you may couple perform pay the loan to one another.

Professionals to be a Co-Debtor ??

Most of the borrowers have control rights to almost any physical property or assets on the loan and you can the means to access people lent financing.

Using multiple earnings and you will credit ratings may help co-borrowers be eligible for finest mortgage conditions otherwise a much bigger loan than if the for each and every borrower applied yourself.

Their credit ratings get improve if one makes into the-go out repayments plus the mortgage servicer reports your instalments with the credit bureaus.

Disadvantages to be a beneficial Co-Borrower ??

You’re accountable for the entire loan amount, not simply your own 50 % of. If an effective co-debtor misses costs, that can connect with other co-consumers, together with ruining everyone’s credit ratings.

Mortgages: Brand new exemption

In terms of co-individuals to own mortgages, there’s absolutely no difference in a beneficial co-borrower and you may a co-signer. Each other borrowers are usually named co-candidates. Your co-candidate will select who has ownership legal rights towards property dependent on exactly who physical lives to the property.

Like, when you are a good co-candidate and no ownership liberties (exactly like an effective co-signer), you’d be a low-renter co-applicant. But when you are a beneficial co-candidate with ownership liberties (similar to a great co-borrower), you’d be a beneficial co-candidate.

Would it be Best to Feel a good Co-Signer otherwise a great Co-Borrower?

If you are questioning whether it’s best to end up being good co-signer otherwise a good co-debtor, it depends on your condition and you will requires towards loan.

- You don’t wish possession or use of funds, and also you should not show monthly installments.

- You want the option to appear on the financing when the an important debtor refinances the mortgage or if co-signer launch can be found.